Investing is a strategic journey, and understanding how your investments are helping or hurting you achieve your financial goals is crucial for making the best financial decisions. Whether you manage your own investments, are professionally advised, or eager to learn more before starting your journey, understanding investment performance is key.

Here are some of the most important elements to be aware of when considering the best strategy for you:

1. Decoding Returns

Returns represent the gains or losses on an investment over a specific length of time. Investment returns are expressed as a percentage of the initial investment. For example, if you invested $1,000 and your returns are 10%, you would receive a profit of $100. Returns can be positive, negative, or zero (often called ‘flat returns’).

Ways to think about returns

There are two valid and accepted methods typically used to evaluate rate of return (RoR). In simple terms, the time-weighted RoR considers how an investment product performs while a money-weighted RoR also considers when and how much you invest.

CIRO dealers are required to use a money-weighted rate of return when telling you about investment performance. Always ask your dealer or advisor for clarification if you are unsure.

2. Compounding and Reinvestment

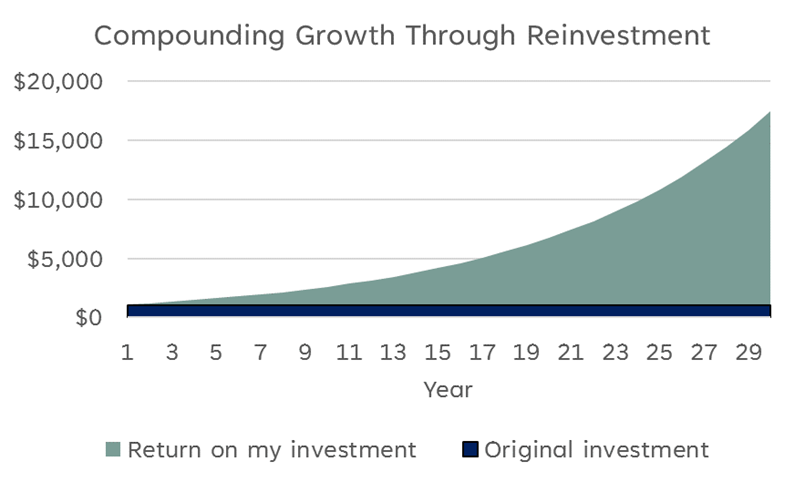

You can maximize your nest egg growth by reinvesting returns. From the example above, let us assume you invest $1,000 today and expect it to grow by 10% per year. Next year you will still have your original $1,000 and a $100 return. Instead of spending your $100 return, you can reinvest it and earn 10% on $1,100. Repeating this process year after year means you benefit from compounding growth.

3. Time Horizon Matters

The amount of time you hold an investment significantly affects its returns and value.

- Short-term investments have less time to grow and can be affected by temporary swings in the market.

- Long-term investments generally provide higher returns as they have more time to increase in value and compound.

It is important to consider a time horizon that fits your financial goals. Ask yourself, if I invest my cash now, when will I need it back to spend?

4. Risk and Reward

All investments come with varying degrees of risk. Higher-risk investments may yield higher returns but also carry the potential for more significant losses. Striking the right balance based on your goals is crucial for a well-rounded investment strategy.

See our resources on understanding risk and assessing your own risk tolerance in our Investor Questionnaire.

5. Diversification

Diversifying your investments means separating your money into different buckets called asset classes (i.e., stocks, bonds, gold, real estate, etc.). This strategy helps prevent your entire portfolio from dropping in value when one asset class does not perform well. A diversified portfolio can provide stability and enhance overall performance.

6. Benchmarking

Benchmarking means comparing your investment performance to a standard measure. The standard measure in Canada is commonly the S&P/TSX Composite index, often simply called “the market”. This index acts as a stock market thermometer and reflects the price of most individual company stocks. Outperforming the benchmark suggests effective management, while underperformance may mean reevaluating your strategy.

7. What’s Hurting My Investment Performance?

Fees

Understanding the fees associated with your investments is vital. High fees can diminish your returns over time, and even small fees can compound over time to have a big effect on your nest egg. Be aware of transaction costs, management fees, and other expenses that may affect your investment profitability. See our resources on fees and costs for more detail.

Taxes

How your investments perform, where your investments are held, and when you “cash out” can all have tax implications. See our resources on the types of accounts you can hold investments in which have special tax treatments. When in doubt, it is always recommended to speak with a tax expert or your financial advisor about investment account types.

8. Monitoring and Adaptation

Regularly monitor your investments and be prepared to adapt your strategy as market conditions change. As asset prices fluctuate, you may need to rebalance your portfolio to maintain a level of risk that is appropriate to you and your goals. You should also consider adjusting your strategy as your personal life changes. Getting married, changing career paths, and supporting aging parents are a few examples of how your financial situation may change.

9. The Effect of Inflation

Inflation simply means the prices of everyday goods and services are increasing. As a result, the amount of stuff you can buy with each dollar decreases. It is important to consider whether your investments have been outperforming inflation to at least maintain the value of your money. If your goal is to ‘beat inflation’, make sure you are taking on only the amount of risk you are comfortable with and can afford.

Conclusion

Navigating the complexities of investment performance involves understanding returns, managing risk, diversifying wisely, and staying vigilant in your financial journey. By grasping these fundamental concepts, you empower yourself to make informed decisions, helping you work towards your financial goals. Remember, while the financial markets may not be smooth sailing, a well-informed approach can help you navigate them with confidence.

Happy investing!