There are many ways to invest. Your choices will depend on your goals, your timeline and your willingness and ability to accept risk. It’s important to know some basics.

Investing puts your money to work to achieve your financial goals. One way is to earn interest on a sum of money you invest. Another way is to make a return by purchasing an investment at a certain price with the goal of selling it later at a higher price. An investment advisor can guide you in choosing the type of investment that best meets your financial goals.

Types of Investments and Types of Accounts

5 Key Principles of Investing

Here are some basic rules to keep in mind before you start on your investing journey

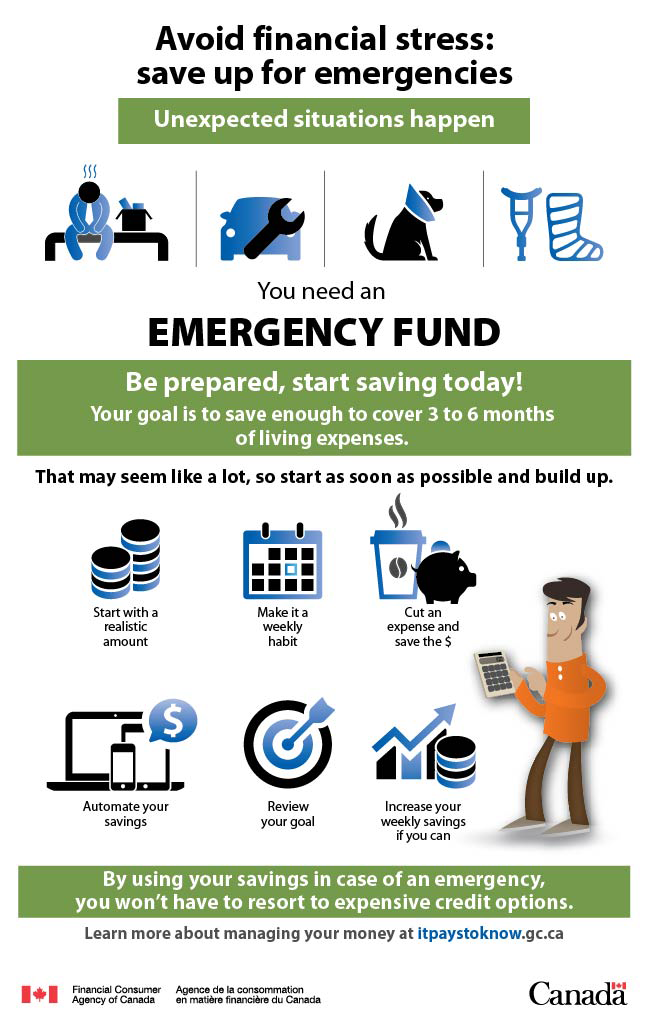

In today’s environment, many Canadians have significant financial obligations aside from investing. People carrying large credit card balances or who may have to borrow to invest or invest on margin should not invest yet. Also, make sure your household or living expenses are covered before turning to investments. You should not be investing if you are not able to make rent or mortgage payments or pay for groceries. These ideas may seem simple, but many people, surprisingly, do not follow them.

People should also make sure that they have enough saved in a reserve or emergency fund in order to absorb a financial shock such as a job loss, illness or other unexpected expenses. In general, you should have enough saved in such an emergency fund to cover expenses for at least 3 months. This will help you avoid high interest loans or credit when such unplanned expenses arise.

Diversification refers to distributing your investments among various asset types (i.e stocks, bonds, and real estate), various sectors or industries (i.e. technology, financials, energy and natural resources etc.) as well as regions. Diversification reduces the overall risk of your investments. It can also help you obtain more stable returns over time as it prevents you from putting all of your eggs in one basket.

Most successful investors have a long-term approach to their investing. Maintaining a longer term perspective of your objectives helps you resist the urge to make trades based on emotions A long term perspective also helps you resist the urge to make trades at times of market turbulence. Over time, long term investors also save on fees and will benefit from the compounding of interest and dividends on their investments. As a result, long term investors generally experience better returns.

Risk of investments vary amongst the various types of investments. For example, in general, equities carry a higher risk than bonds or Guaranteed Investment Certificates (GICs) Investors are often attracted by the promise of high returns. However, many of these investments come with higher risks and a higher potential for loss, or worse – they are frauds or scams You should be wary of rates of return that sound too good to be true, because they probably are.

Your appetite for risk may also change over time. As you get closer to retirement or begin retirement, you may be less inclined to take on additional risks with your money as you are focused on preserving your wealth. Many investors change their investing strategies and their risk profiles as they enter this phase of their lives.

A good guideline when it comes to investing is that if you cannot explain what you are investing in to a child, then you likely should not be investing in it. Complex investments or strategies that you don’t understand don’t usually lead to better results. In particular, you should understand what your investment is (or underlying investments are), how it generates income or capital, what costs are associated with the investment and what risks are associated with the investment. If these details are too complicated for the investment you are considering, consider finding something simpler.

Understanding Financial Certifications

When choosing an advisor, educational achievements and professional experience are important. But financial certificates do not necessarily mean advisors are registered with a regulator. Learn more about financial certifications and what they mean.

Budget Planner

Having a budget helps you create some predictability to your financial life. Tracking your income and expenses and sticking to a plan will help you build financial stability today and in the future. Check out the FCAC’s Budget Planner tool and start today.