Paying Down Debt vs. Investing

Either is a worthy goal.

In the scope of personal finance, individuals often struggle with the decision of whether to pay down debt they’ve accumulated or allocate funds towards investments that will grow for the future. Either choice can make sense, depending on the situation and each individual’s stage of life. In this article, we’ll look at the highlights surrounding paying down debt and investing, shedding light on the factors that can help you make informed financial choices.

PAYING DOWN DEBT: The case for financial freedom

Debt is the money that you’ve borrowed and are now paying interest on. If left unpaid, debt will grow and grow, with interest charges adding to your balance. There are several good arguments for choosing to pay down debt rather than investing, here are a few:

1. Interest Costs

You might come out ahead if your debt carries a relatively high interest rate. High-interest debts, such as credit card balances or certain loans, can collect large amounts of interest over time. The average interest rate on credit cards in Canada recently was between 19.99% and 25.99%. Few investments can match that rate of return. Selecting debt repayment can lead to major savings on interest payments, offering you a quicker path to financial freedom.

This is especially true in a rising interest rate environment. When rates go up, the interest between payments also goes up. So, even if the payments stay the same, less of the payment goes towards paying off the loan. Paying down debt as much as possible during interest rate hikes may help you avoid financial stress caused by bigger loan payments (or less of your money going toward the principal of your loan).

2. Reduced Financial Stress

Mindset comes into play here. Carrying heavy debt can be emotionally difficult. If you’re losing sleep over your debts, then you could be better off repaying them. Focusing on debt repayment gives a sense of financial relief, freeing you from the stress and uncertainty with owing money.

3. Improved Credit Score

Another important reason for timely debt repayment is your credit score. An important number if you want to borrow money in the future (i.e., mortgage or car loan). The higher your credit score the better chance you have at paying lower interest rates. Your credit score can also have an effect on other things, such as the premiums you’ll pay for insurance and whether a landlord will rent to you. A strong credit history opens doors to better financial opportunities.

INVESTING: The case for wealth growth

A general rule of thumb is if you can make more interest on your money by investing it when compared to what your debts are costing you, then it makes sense to invest. However, it isn’t always that simple. Investments can be volatile. Here are some factors to think about:

1. Long-Term Wealth Building

Investing has the possibility to make long-term wealth through the power of compounding. If you focus on paying down debt only, you miss out on the benefits of compounding interest. By putting money into assets like stocks, bonds and mutual funds you can gain from the growth of these investments over time. As an investor, time can be your friend when it comes to compound interest, so the earlier you start, the more your money can grow. For more information on how compounding works, refer to The Office of the Investor’s “Compound Interest: A Powerful Force in Finance” article.

That said, if you have a low risk tolerance and are uncomfortable with your investments sometimes rising in value and sometimes losing value, then you might not be as good a candidate for investing than someone with a higher risk tolerance.

2. Inflation

Investing can be a way of overcoming rising prices if the returns you make are higher than the rate of inflation. Historically, investments that maintain value and generate returns throughout economic fluctuation such as commodities and inflation-indexed bonds have been used to protect against inflation. As the value of money goes down over time, well-chosen investments and a properly diversified portfolio have the potential to outperform inflation, protecting and growing wealth.

3. Tax Benefits

The tax benefit connected with carrying certain debt is another argument for considering investing ahead of paying off debt. For example, interest on investment property loans and student loans may be deducted from taxes. Lowering your taxable income for the year may result in you taking home more of your income.

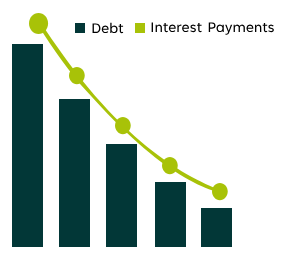

Investing

Takeaway: We hope for a benefit.

Depending on the investment and time horizon, value can increase, decrease, or hold steady.

Paying Down Debt

Takeaway: Benefit is guaranteed.

Debt and interest payments decrease over time so long as you make regular payments.

STRIKING A BALANCE: Invest and pay down debt

For some, paying down debt vs. investing doesn’t have to be an either/or decision, it’s possible to do both. Invest and pay down debt.

Keep a detailed budget that outlines the goal for every dollar you make (i.e., pay bills, go into savings or pay down debt). Organizing your income and setting goals will make tracking your steps forward easier. Be sure to give yourself a deadline for reaching them. It’s important to regularly go over your budget to find “extra” money. For example, stopping subscriptions and canceling unused membership can help free up extra dollars. Check out the FCAC’s Budget Planner tool and start today.

Consider debt relief options such as a debt management plan to help lower and simplify your debt. This can also allow you to combine multiple card balances at a single low rate. The money you save through such efforts can be put toward investing for retirement.

THE BOTTOM LINE

The decision between paying down debt and investing is like solving a riddle, one that depends on individual circumstances and financial goals. Everyone’s financial situation and personal feelings toward saving and debt management are different. People must carefully assess their situation, interest rates, investment objectives and risk profile to find a balance that lines up with their overall financial strategy. Whether prioritizing debt repayment for financial freedom or accepting investment opportunities for long-term wealth building, informed decision-making is key to reaching financial well-being.